sales tax calculator hayward

For tax rates in other cities see Minnesota sales taxes by city and county. Within Milpitas there are around 2 zip codes with the most populous zip code being 95035.

California Vehicle Sales Tax Fees Calculator

The Sales tax rates may differ depending on the type of purchase.

. For tax rates in other cities see California sales taxes by city and county. MN Sales Tax Rate. Businesses impacted by the pandemic please visit our COVID-19 page Versión en Español for information on extensions tax relief and more.

Divide tax percentage by 100. The 55 sales tax rate in Hayward consists of 5 Wisconsin state sales tax and 05 Sawyer County sales tax. Search Sales and use tax jobs in Hayward CA with company ratings salaries.

The California sales tax rate is currently. The minimum combined 2022 sales tax rate for Hayward California is. Hayward Sales Tax Rates for 2022 Hayward in California has a tax rate of 975 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Hayward totaling 225.

Fast Easy Tax Solutions. The sales tax rate does not vary based on zip code. For questions about filing extensions tax relief and more call.

Apply more accurate rates to sales tax returns. Online videos and Live Webinars are available in lieu of in-person classes. If this rate has been updated locally please contact us and we will update the sales tax rate for Saint Helena California.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. The December 2020 total local sales tax rate was also 5500. The price of the coffee maker is 70 and your state sales tax is 65.

Multiply price by decimal tax rate. The current total local sales tax rate in Hayward MN is 7375. The average cumulative sales tax rate in Milpitas California is 938.

You can print a 55 sales tax table here. The Hayward California sales tax is 975 consisting of 600 California state sales tax and 375 Hayward local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 300 special district sales tax used to fund transportation districts local attractions etc. Quickly learn licenses that your business needs and let Avalara manage your license portfolio.

The average sales tax rate in California is 8551. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Download all California sales tax rates by zip code.

Put your rates to work by trying Avalara Returns for Small Business at no cost for up to 60 days. Where you need to register. In some states the sales tax rate stops at the state level.

The 1075 sales tax rate in Hayward consists of 6 California state sales tax 025 Alameda County sales tax 05 Hayward tax and 4 Special tax. You can find more tax rates and allowances for Hayward and California in the 2022 California Tax Tables. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

The current total local sales tax rate in Hayward CA is 10750. This is the total of state county and city sales tax rates. For example the state rate in New York is 4 while the state sales tax rate in Tennessee is 7.

You can print a 7375 sales tax table here. The December 2020 total local sales tax rate was also 7375. The sales tax jurisdiction name is Sawyer which may refer to a local government division.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The Hayward sales tax rate is. List price is 90 and tax percentage is 65.

There is no applicable county tax or city tax. Ad Find Out Sales Tax Rates For Free. The December 2020 total local sales tax rate was 9750.

The current total local sales tax rate in Hayward WI is 5500. Hawaii has a 4 statewide sales tax rate but also has four local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0431 on top of. These usually range from 4-7.

The County sales tax rate is. You can print a 1075 sales tax table here. 70 0065 455.

Hayward WI Sales Tax Rate. The 7375 sales tax rate in Hayward consists of 6875 Minnesota state sales tax and 05 Special tax. Hayward CA Sales Tax Rate.

176 open jobs for Sales and use tax in Hayward. The sales tax jurisdiction name is Freeborn which may refer to a local government division. There is no applicable city tax or special tax.

Milpitas is located within Santa Clara County California. Sales tax in Palm Springs California is currently 875. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

The sales tax rate for Saint Helena was updated for the 2020 tax year this is the current sales tax rate we are using in the Saint Helena California Sales Tax Comparison Calculator for 202223. The sales tax rate for Palm Springs was updated for the 2020 tax year this is the current sales tax rate we are using in the Palm Springs California Sales Tax Comparison Calculator for 202223. California has a 6 statewide sales tax rate but also has 474 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2617 on top of the state tax.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. This means that depending on your location within California the total tax you pay can be significantly higher than the 6 state sales tax. 65 100 0065.

If this rate has been updated locally please contact us and we will update the sales tax rate for Palm Springs California. You will pay 455 in tax on a 70 item. The state sales tax rate is the rate that is charged on tangible personal property and sometimes services across the state.

This includes the rates on the state county city and special levels.

Transfer Tax Alameda County California Who Pays What

California Vehicle Sales Tax Fees Calculator

Why Does California Have Some Of The Highest State Income Tax And State Sales Tax In The Country Quora

/https://s3.amazonaws.com/lmbucket0/media/business/8493_Hayward_CA_Ext_01.21ce42cd42bc9aba0a7eae3df29552eb1c3abb95.jpg)

T Mobile Southland Mall Hayward Ca Hayward Ca

2022 Handicap Ramps Cost Calculator Hayward California Manta

Transfer Tax Calculator 2022 For All 50 States

California Vehicle Sales Tax Fees Calculator

How To Use A California Car Sales Tax Calculator

Why Does California Have Some Of The Highest State Income Tax And State Sales Tax In The Country Quora

California Vehicle Sales Tax Fees Calculator

California Sales Tax Calculator

California Vehicle Sales Tax Fees Calculator

Used Cars Under 10 000 For Sale In Hayward Ca Autonation Toyota Hayward

Transfer Tax Alameda County California Who Pays What

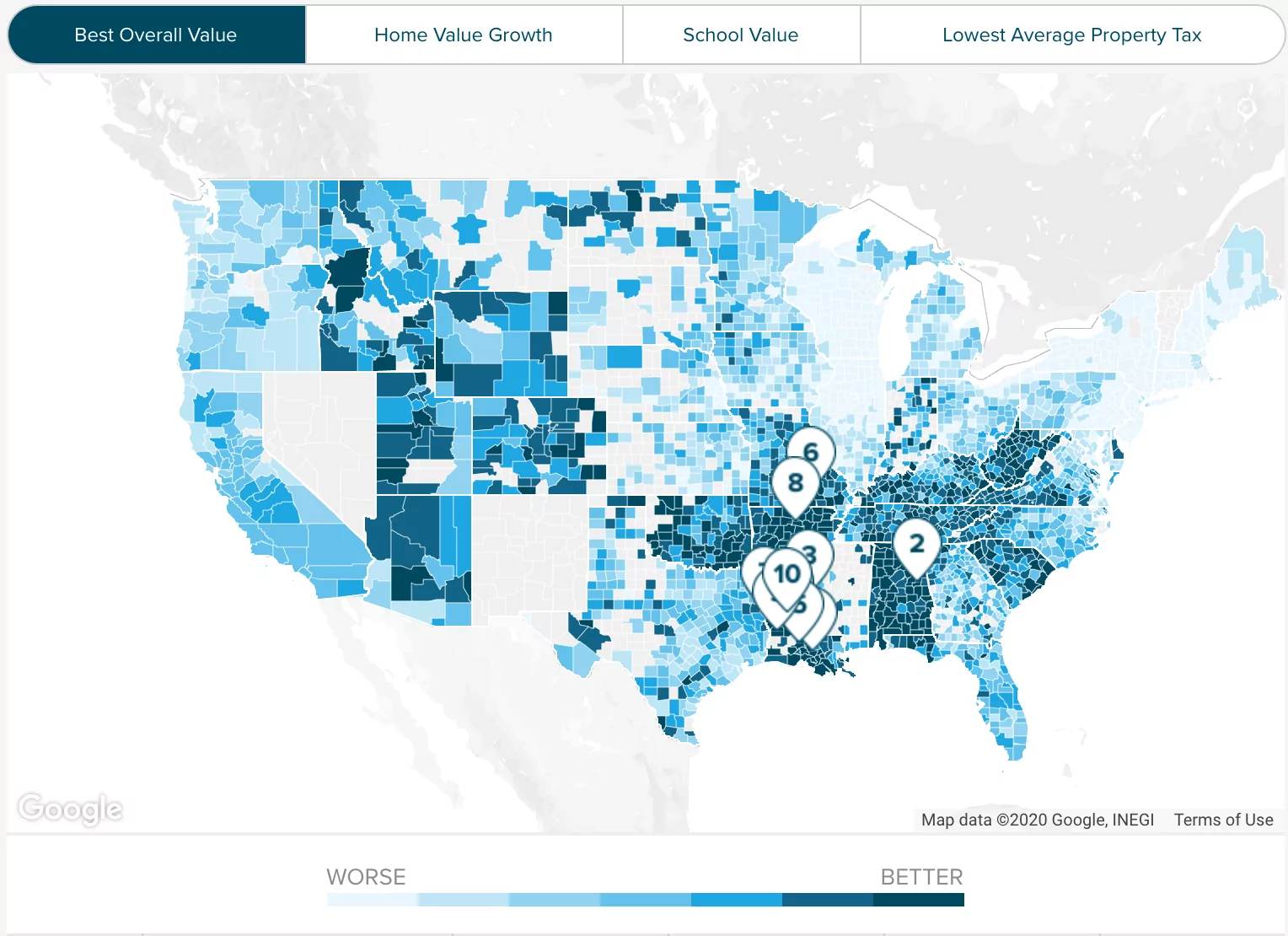

Alameda County Ca Property Tax Calculator Smartasset

Sales Gas Taxes Increasing In The Bay Area And California

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax